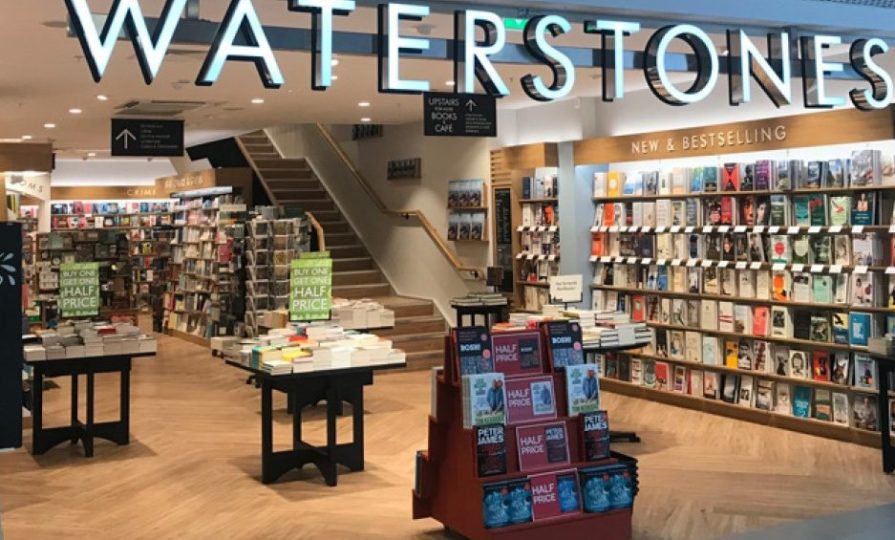

Waterstones and Barnes and Noble owner eyes IPO

The group’s financial year runs to April, making a flotation unlikely before late summer at the earliestThe group’s financial year runs to April, making a flotation unlikely before late summer at the earliest

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

The owner of Waterstones and Barnes and Noble, Elliott Management, is reportedly preparing for a potential multibillion-pound flotation with a listing expected next year, according to the Financial Times.

According to people familiar with the matter, the US hedge fund has held discussions with potential advisers about an initial public offering and could appoint investment banks in early 2026.

A listing in London or New York is reportedly under consideration.

One source said London is currently seen as the preferred venue, citing the steady cash generation of the businesses, which could appeal to income-focused UK investors.

The FT stated that no final decision has been taken and the plans could still change.

The group’s financial year runs to April, making a flotation unlikely before late summer at the earliest.

Barnes and Noble and Waterstones are the largest booksellers in the US and UK respectively.

The FT said it learned that other private equity-backed businesses, including roadside recovery group RAC, are also considering potential listings in the capital.

Together, the firms operate 775 stores in the US and 316 in the UK. The group generated about $3bn (£2.24bn) in sales last year, producing roughly $400m (£299m) in profit.

The business has expanded rapidly under chief executive James Daunt ahead of a possible flotation, opening dozens of new shops. Daunt has run Waterstones since 2011 and also owns an independent UK bookshop chain under his own name.

During his tenure, Waterstones has acquired several rival booksellers, including Foyles, Hatchards and Blackwell’s. Elliott acquired Waterstones in 2018 for an undisclosed sum and went on to buy Barnes and Noble in 2019 for $683m (£510.4m).

Daunt told CNBC earlier this week that trading had been strong. He said: “Book sales were doing very well . . . 2025 has been a fantastic year for us.” He added that the group had opened 67 new stores in the US this year.

Elliot has been contacted for comment.