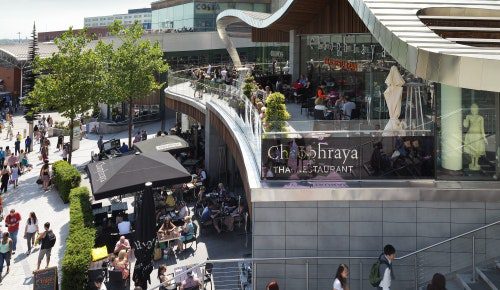

High Street

Hammerson returns to profit

However, the group also saw revenue fall to £62m from £65.3m

Hammerson has revealed a pre-tax profit of £50m for the six months ending June 28, contrasted with a £376m loss over the same period in 2021.

You'll need to

subscribe to unlock this content. Already subscribed? Login?