Clothing & ShoesNews

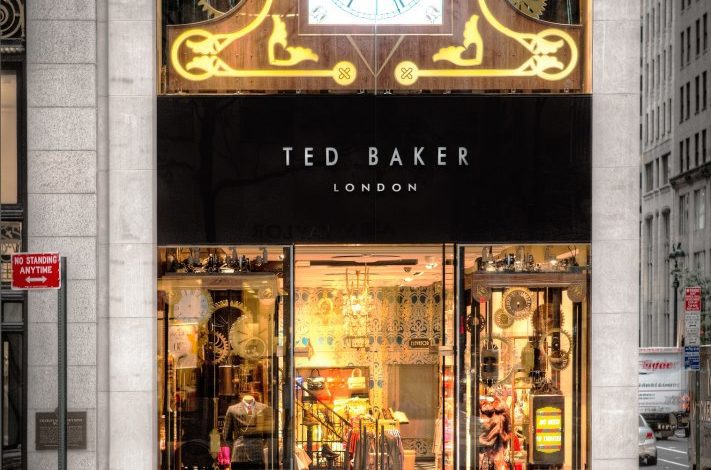

Ted Baker receives ‘number of bids’ as sales process continues

Ted Baker will provide potential partners with its business information upon signing a non-disclosure agreement

You'll need to

subscribe to unlock this content. Already subscribed? Login?