SKG targets £20m retail acquisition spree

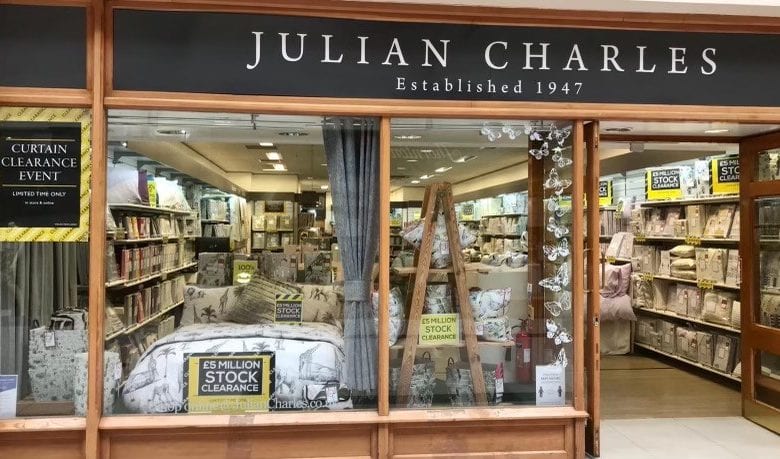

The acquisitions will target struggling retailers, looking to turn the businesses around in a similar fashion to its Julian Charles experience

SKG Capital, the owner of bedding and linen retailer Julian Charles, has announced that it is looking to invest £20m in retail and consumer firms across the next 12 months.