Over £500m wiped from Ocado’s value as Kroger rethinks investment

Shares fell by almost 20% after US supermarket chain Kroger said it would take a ‘hard look’ at further investment into Ocado’s network of robot-operated warehouses

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

More than £500m was wiped from Ocado’s market value last week after its US retail partner said it would review investment into its automated warehouses.

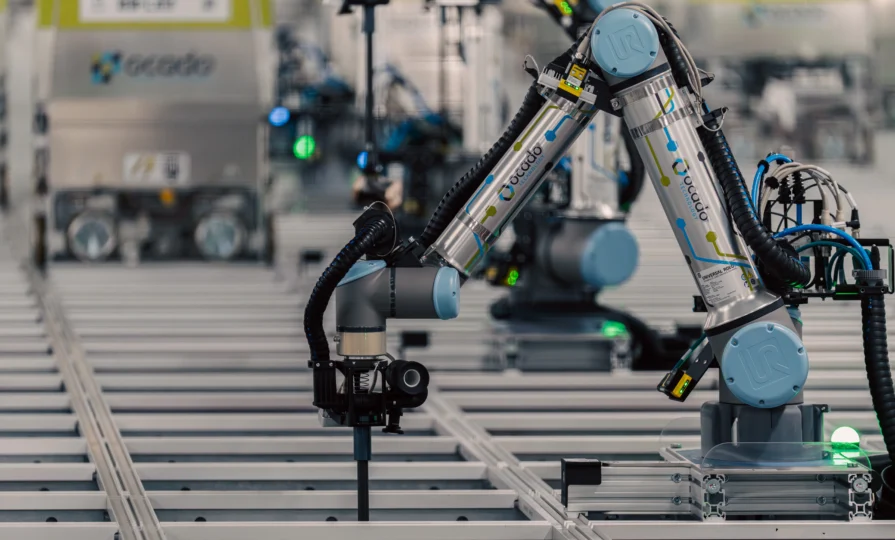

The group’s shares fell by almost 20% after US supermarket chain Kroger said it would take a “hard look” at further investment into Ocado’s network of robot-operated warehouses.

In a call to analysts, chair and interim CEO of Kroger, Ronald Sargent, said the group would “evaluate all options across all facilities to improve profitability” and conduct a “full site-by-site analysis” of the automated fulfillment network.

He told analysts: “Where we have seen strong demand in high-density areas, these facilities deliver better results than those facilities where density is lower and customer adoption has been slower.”

Kroger is Ocado’s biggest warehouse technology client, after Ocado signed a partnership agreement in 2018 to build 20 automated warehouses in the US. Only eight are currently operational.

Kroger is the largest supermarket operator in the States, and operates big name brands including Fred Meyer, Ralphs, King Soopers, Harris Teeter as well as its namesake brand. It has nearly 2,800 stores across the US.

According to The Times, analysts do not expect Kroger to walk away from the Ocado contract but do not anticipate any “material new” warehouse orders in the near future.

An Ocado spokesperson told the paper: “Kroger announced its operational review last quarter, which is looking to drive growth and profitability across all aspects of its operations, including stores, ecommerce and non-core assets.

“As we spoke about at our interim results in July, we are continuing to work closely with Kroger to drive this further and have made positive progress.”

Ocado has been contacted for further comment.