Mulberry HY losses narrow as full-price sales lift margins

However, the luxury retailer saw its revenues fall 4% to £53.9m as declines in Asia Pacific offset growth in wholesale

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Mulberry Group has reported that its losses before tax narrowed, from £15.3m to £7.4m, in the 26-week period to 27 September, as the luxury brand pushed ahead with its turnaround strategy and tightened control of costs.

The group also maintains that trading remained in line with board expectations during the period.

Story Stream: More on Mulberry

However, the luxury retailer saw its revenues fall 4% to £53.9m as declines in Asia Pacific offset growth in wholesale. Like-for-like retail and digital revenues likewise slipped 2%, although store sales in the UK, Europe and the US rose 4% across full-price and off-price channels.

Meanwhile, wholesale revenues jumped 36%, which the company said reflected the strategic emphasis on that area.

Gross margin strengthened to 69% from 67%, supported by a focus on full-price sales. Operating expenses fell 16% to £42.7m after a review of the cost base.

Asia Pacific revenue fell 17% following store closures and a 14% like-for-like decline. Mulberry closed six stores in the region as part of a simplification of its structure. The group also signed new wholesale agreements in the UK with John Lewis, Liberty and Harvey Nichols, and launched the first products developed under its new creative team.

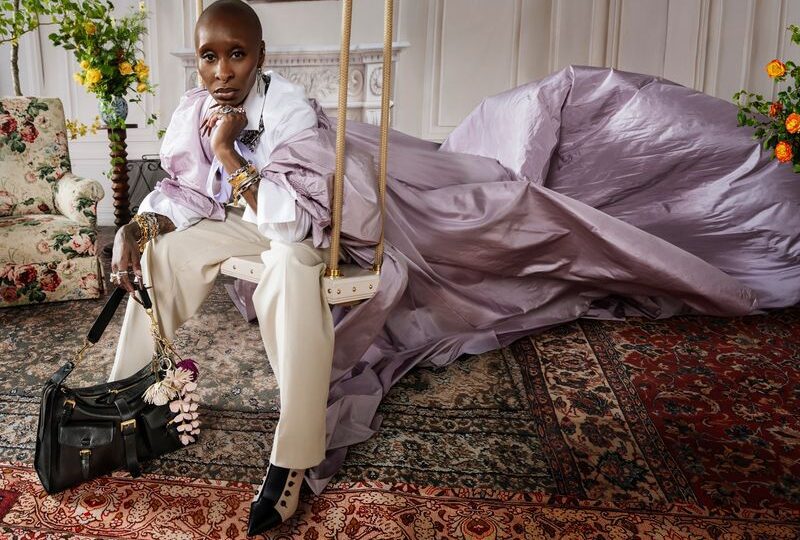

Marketing efforts included the appointment of Cynthia Erivo as a brand ambassador in September. A new retail incentive scheme contributed to revenue growth of 11% across European stores and 10% in the UK in comparable locations. Pre-loved sales rose 46% following the continued expansion of the brand’s buyback programme.

Mulberry said it remained focused on restoring profitability, supported by a £20m fundraise through convertible loan notes from its two largest shareholders. The second half will include the release of new product families – the Hackney, Lennox and Boston – and the rollout of the Christmas campaign launched in early November.

Andrea Baldo, chief executive of Mulberry, said: “This has been an encouraging first half as we continue to deliver our ‘Back to the Mulberry Spirit’ strategy. We’re still early in the turnaround, but the foundations we’ve put in place are working, and we’re starting to see that reflected in performance.

“We’re strengthening our margin and improving our cash position through a greater focus on full-price sales and disciplined cost management, while our refreshed product offer and creative direction are reconnecting the brand with customers.”

He added: “While we remain mindful of the wider trading environment, current momentum gives us confidence as we enter the key festive trading period. We’re focused on maintaining this progress and continuing to build a stronger, resilient business for the long term.”