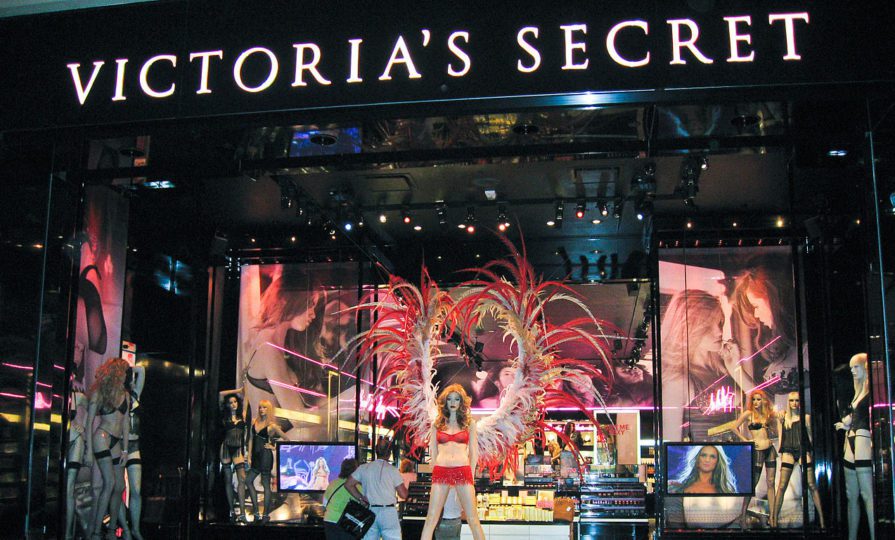

Victoria’s Secret acquires Adore Me

Adore Me will serve as an important long-term growth vehicle for Victoria Secrets and will generate an estimated $250m (£207.2m) of profitable sales

Victoria’s Secret has announced that it has completed the acquisition of Adore Me, a digitally-native intimates brand.