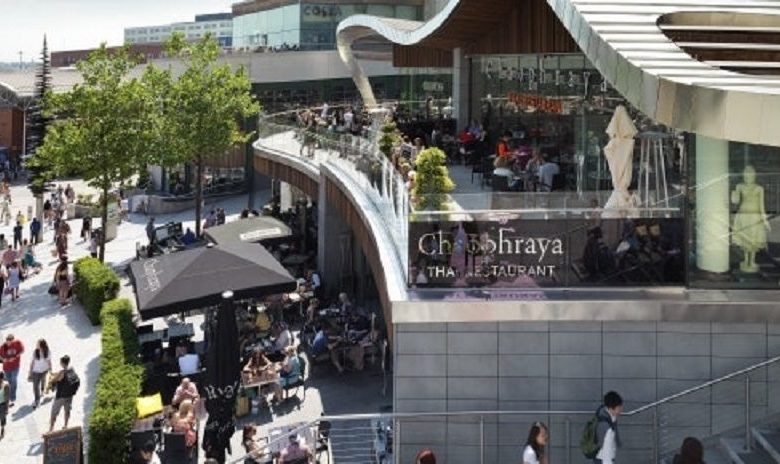

Shopping Centres

Hammerson reports £268m loss and eyes further disposals

Shopping centre owner Hammerson has reported a loss of £268.1m in its 2018 FY results, also announcing it aims to make £500m in disposals this year.

You'll need to

subscribe to unlock this content. Already subscribed? Login?