Hammerson abandons £3.4bn takeover of Intu

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Shopping centre owner Hammerson has revealed it has reversed its decision to buy its rival Intu for £3.4bn.

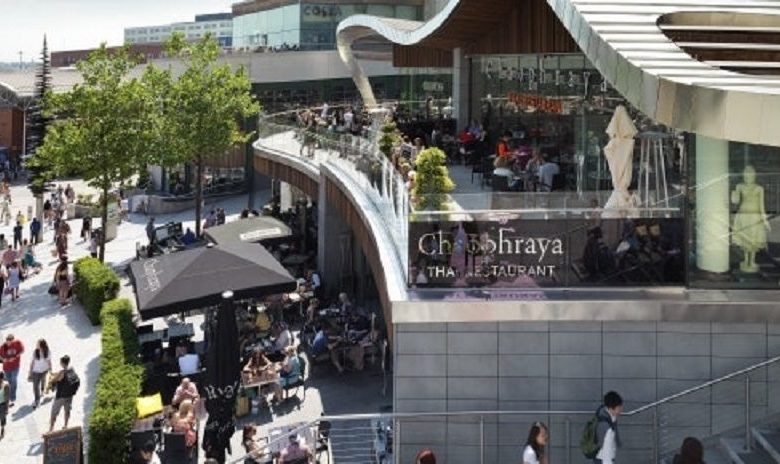

The owner of Birmingham’s Bullring proposed an all share merger with Intu in December last year which would have resulted in the UK’s biggest property company, worth £21bn.

However the board has now withdrawn its recommendation to shareholders to vote in favour of the deal citing “the equity market’s perception of the broader UK retail property market has deteriorated since the start of the year”.

It added: “This perception has been intensified by market concerns over the extended period of time that it would take to complete the transaction and realise longer-term returns from the Intu acquisition.”

The news comes only a week after French estate firm Klépierre abandoned a £5bn bid for Hammerson following numerous rejections from the British company.

David Tyler, chairman of Hammerson, said: “After careful consideration, the board has concluded it is no longer in the best interests of shareholders to carry out the Intu acquisition.

“In recent weeks, investors have told us they share our view of the exceptional quality of our portfolio and that they have great confidence in our management team. The board has complete conviction in Hammerson’s prospects as a standalone business as we pursue our plans for future growth.”

David Atkins, chief executive, added: “Hammerson is an ambitious company with a disciplined approach to the pursuit of compelling investments to strengthen its portfolio. It is clear that the heightened risks to the Intu acquisition now outweigh the longer-term benefits. We have a clear strategy that has delivered consistent, strong returns on a standalone basis and we look forward to updating the market in the near term on our plans to accelerate the delivery of further value for shareholders.”