Stock Market

This coverage tracks the stock market performance of key retailers and related companies, with analysis of share price movements, financial results, and investor sentiment. Reporting highlights earnings announcements, strategic updates affecting valuations, market reactions, and executive commentary — equipping retail professionals with insights into how public markets view the sector’s commercial and strategic developments.

-

Mar- 2024 -6 MarchNews

Today’s news in brief-6/3/24

Currys shareholder JO Hambro Capital Management urged the company to hold out for a £1bn offer amid takeover talks. Despite rejecting a bid from Elliot valued at 67p per share, Currys faces pressure to consider higher offers, with JOHCM deeming an offer between 80p and 100p per share as “acceptable”.…

Read More » -

6 MarchElectrical

Shareholder calls for Currys to hold out for £1bn offer

A Currys shareholder, JO Hambro Capital Management (JOHCM), has stated that the electronics retailer should hold out for an offer of £1bn amid takeover talks. According to The Standard, JOHCM, a UK equity income fund, stated that an offer between 80p and 100p per share would be “acceptable”. An offer…

Read More » -

Feb- 2024 -28 FebruaryClothing & Shoes

Shein mulls London IPO amid resistance to New York listing

Shein is reportedly considering the possibility of switching its initial public offering to London from New York in what could be one of London’s biggest ever IPOs, Bloomberg has reported. According to reports, the fast-fashion company is in the early stages of exploring the London option in case US regulators…

Read More » -

21 FebruaryElectrical

Currys shareholder Redwheel warns of stock market decline

Currys’ largest shareholder, Redwheel, has warned that more foreign firms will begin to circle London companies after the electronics retailer rejected a takeover bid from US hedge fund Elliott, The Telegraph has reported. Redwheel, which holds 14.6% of shares in Currys, said it was in “complete agreement” with the retailer’s…

Read More » -

14 FebruaryNews

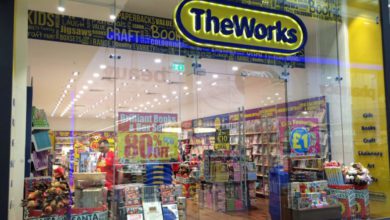

The Works appoints two non-exec directors

The Works has announced the appointment of John Goold and Mark Kirkland as non-independent non-executive directors effective immediately. Goold is chief executive officer and Kirkland is chief financial officer at Kelso Group Holdings plc, an investment company that seeks to identify, engage and unlock trapped value in the UK stock…

Read More » -

Dec- 2023 -18 DecemberNews

Today’s news in brief-18/12/23

Farfetch is reportedly in advanced talks with a private equity-backed buyer for a last-minute rescue deal. The deal, if successful, would involve taking Farfetch off the stock market in a take-private transaction and would result in the company receiving $500m (£394m) in emergency funding. Talks are ongoing, and while Farfetch…

Read More » -

18 DecemberClothing & Shoes

Farfetch seeks last-minute rescue deal

Farfetch is reportedly looking to secure a last-minute rescue deal with a private equity-backed buyer, according to The Sunday Times. Whilst the buyer’s identity is unclear, The Times reported that advanced talks are in place over a deal to take the online retailer off the stock market in a take-private…

Read More » -

13 DecemberNews

Today’s news in brief-13/12/23

Walgreens Boots Alliance (WBA), the US-based parent company of Boots, is reportedly exploring an initial public offering (IPO) on the London Stock Exchange, reviving plans to divest the pharmacy chain. Walgreens had abandoned a £5bn sale of Boots last year, citing challenges in global financial markets. The potential IPO is…

Read More » -

13 DecemberHealth & Beauty

Boots owner eyes London IPO amid revived disposal plans

Boots’ US-based parent company, Walgreens Boots Alliance, is reportedly eyeing an initial public offering (IPO) on the London Stock Exchange as the group revives plans to offload the pharmacy chain, according to Bloomberg. The news comes after WBA abandoned Boots’ £5bn sale and its No7 beauty brand last year, having…

Read More » -

7 DecemberNews

Today’s news in brief-7/12/23

Kelso, an activist shareholder in THG, has intensified its campaign for THG to clarify its plans to separate its three business divisions. Kelso believes that splitting the divisions (beauty, nutrition, and ecommerce services) would bridge the gap between THG’s share price and its true value. The shareholder has written to…

Read More »