Interest Rates

This coverage explores UK interest rate movements and their impact on the retail industry, focusing on monetary policy decisions, borrowing costs, consumer spending, and retailer financing strategies. Reporting highlights how rate changes affect sales dynamics, investment planning, and operational budgets — providing insight for executives, finance leads, and business strategists navigating economic volatility.

-

Jun- 2021 -16 JuneEconomy

UK inflation hits 2.1% as clothing prices rise

Inflation in the UK rose to 2.1% in May, up from 1.5% in April, according to the latest figures from the Office for National Statistics (ONS). This increase has been fuelled by an increase in consumer spending as the British public comes out of lockdown. Meanwhile, clothing prices jumped by…

Read More » -

7 JuneOnline & Digital

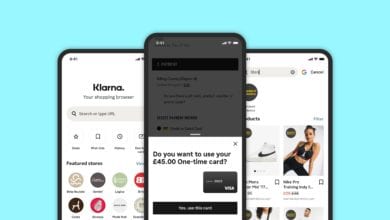

Klarna launches UK shopping feature

Klarna, a global banking, payments, and shopping service provider, has launched a new shopping app. The shopping feature enables UK Klarna users to shop at any online store directly through the group’s app, regardless of whether they are a Klarna partner or not. Through Klarna’s “pay in three” service, customers…

Read More » -

2 JuneDIY

Kingfisher signs £550m responsible credit facility

Kingfisher, the owner of B&Q and Screwfix, has signed a £550m three-year revolving credit facility agreement linked to responsible business targets. Through the agreement, Kingfisher will benefit from lower interest rates if the responsible business plan’s targets are met, with a two-year extension also a possibility. The targets focus on…

Read More » -

Feb- 2021 -22 FebruaryAnalysis

The restructuring options for retailers before it’s too late for rescue

Despite a glimmer of hope that Government may extend more Covid-19 support measures, retailers shouldn’t leave their future to chance if they want to boost their prospects of surviving the pandemic. Up until recent days, it looked like retailers were facing a so-called perfect storm. A moratorium protecting retail tenants…

Read More » -

5 FebruaryCoronavirus

Bank of England holds rates, predicts strong vaccine rebound

The Bank of England (BoE) has predicted an economic rebound in the spring led by a successful vaccine rollout, after revealing it will be holding interest rates at 0.1%. The news comes as the BoE predicts that GDP is expected to fall by around 4% in the first quarter of…

Read More » -

Nov- 2020 -5 NovemberCoronavirus

Chancellor extends furlough scheme to March

Chancellor Rishi Sunak has announced that the furlough scheme will be extended until the end of March, amid increased measures for business support as the UK enters a four-week lockdown. Payments are set to remain at 80% of employee’s wages. It comes as the chancellor said that it was “right…

Read More » -

5 NovemberCoronavirus

Bank of England unveils £150bn covid support package

The Bank of England (BoE) has unveiled it will give the UK economy a further £150bn in crisis support and keep interest rates at a record low, due to the rapid rise in Covid-19 restrictions across the country. At the Banks latest Monetary Policy Committee (MPC), members stated that the…

Read More » -

Jun- 2020 -5 JuneTips

Government-backed loans to UK businesses reveals horrible truth

Due to the rapid spread of Coronavirus Disease (COVID-19) and the toll that it took, the world has been pushed towards fear—halting life as we know it entirely. The blow on the economy was felt all across the world, with governments all over rushing to stem the pandemic to urge…

Read More » -

Mar- 2020 -30 MarchEconomy

UK GDP expected to contract by 15% in Q2 2020

The UK economy is about to enter the deepest recession since the financial crisis, including the steepest quarter-on-quarter decline in economic activity since comparable records began, according to the Centre for Economics and Business Research (CEBR). CEBR expects the economy to have contracted marginally in the first quarter of the…

Read More » -

26 MarchComment

Preventing inevitable recession from becoming depression

The global economy is heading into a recession, initially at least a pretty severe one. The measures introduced by governments in an attempt to slow the spread of the virus are having a dramatic effect on huge swathes of economic activity. There is the direct loss of output and employment…

Read More »