Covid-19

This coverage examines the effects of Covid-19 on the UK retail industry, focusing on operational disruption, financial pressures, consumer behaviour shifts, and recovery strategies. Reporting includes lockdown impacts, safety measures, supply chain challenges, online growth, and leadership decisions that shaped responses to the crisis. Designed for executives and managers, it offers lessons and insights for navigating future disruptions.

-

Jan- 2021 -20 JanuaryAnalysis

Retailers and the pressing question of their real estate portfolios

It is not an understatement to say that Covid-19 has vastly altered markets and the way businesses work within them, especially those in the retail sector. Arguably one of the greatest changes induced by Covid-19 is the rapid take-up of e-commerce in place of physical retail. “Online sales have accelerated…

Read More » -

20 JanuaryClothing & Shoes

Burberry hails strategic progress despite sales decline

Burberry has welcomed a period of “strong” strategic progress in its third quarter, despite sales sliding by 9% in the 13 weeks ended 26 December. The fashion house said that lower sales were attributed to planned reductions in markdown and reduced tourist traffic in outlets. In addition, Covid-19 related store…

Read More » -

20 JanuaryHigh Street

WH Smith trading ‘better than anticipated’

WH Smith has posted its trading update for the 16 weeks to January, with the company reporting a “better than anticipated” sales performance. The group has said it adapted well to the “evolving trading environment” on the high street, with revenue in stores in December at 92% of 2019 levels. …

Read More » -

19 JanuaryGovernment

Sunak looks to raise corporation tax in March budget

Chancellor Rishi Sunak is reportedly looking to raise corporation tax in the upcoming March budget to pay off the estimated £400bn borrowed by the UK throughout the pandemic. According to The Financial Times, the alleged move has sparked uproar among business owners who claim they are still struggling with the…

Read More » -

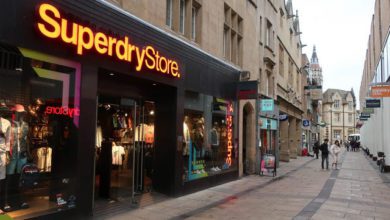

19 JanuaryClothing & Shoes

Superdry swings to £18.9m H1 loss

Superdry has reported an £18.9m loss for the first half of the year, as the company also warned about its ability to continue as a going concern due to the impact of Covid-19 and lockdown restrictions. For the 26-week period to 24 October 2020, it revealed total group revenue declined…

Read More » -

19 JanuaryClothing & Shoes

Matalan revenue falls 21.5% in Q3

Matalan, the out of town fashion and homeware retailer, has announced its year-on-year revenue plummeted 21.5% for the 13 weeks ended 28 November 2020. The drop in sales from £311.7m to £244.8m came as a result of the “severe Covid-19 related disruption” that the November lockdown caused the firm. Adjusted…

Read More » -

18 JanuaryAdvice

How packaging can build retail resilience

The ‘stay at home’ impact of the pandemic is turbocharging the importance of packaging. It is a critical component helping retailers to sell more products online and effectively move goods through busier and changing supply chains that are constantly flexing in response to the impact of Covid-19. At the same…

Read More » -

18 JanuaryClothing & Shoes

Uniqlo reports 7.2% revenue decline

Fast Retailing, the parent company of Uniqlo, has revealed the high street fashion brand’s year-on-year revenue for the quarter ended 30 November 2020 fell by 7.2%. A large profit rise in Asia alongside steady e-commerce expansion did result in a £295m (9.5%) Q1 2021 increase to the firm’s global operating…

Read More » -

18 JanuaryOnline & Digital

Barclay family mulls £3bn Very Group float

The Barclay family is reportedly eyeing up a £3bn float of online retailer Very Group, according to reports from Sky News. The billionaire family, who owns the business, is said to be in the early stages of exploring plans for the flotation in a bid to “capitalise on exploding investor…

Read More » -

15 JanuaryHigh Street

Supreme Court sides with small firms in business interruption insurance case

The Supreme Court has delivered its judgment in the Financial Conduct Authority’s (FCA)’s business interruption insurance test case, with the court’s ruling in the favour of small firms potentially forcing insurers to pay out £1.2bn in CBI claims. Following the judgement, thousands of policyholders will now have their claims for…

Read More »