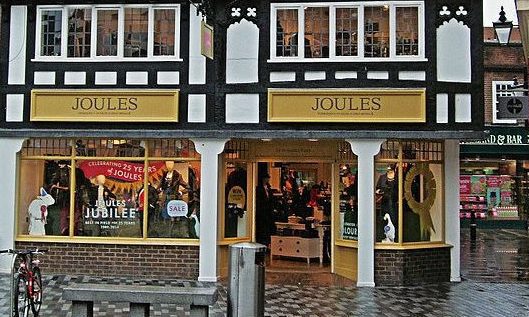

Crew clothing eyes Joules takeover

The news comes after Joules officially appointed administrators last week after talks with potential investors collapsed

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Crew Clothing’s owner and majority shareholder is reportedly considering acquiring embattled retailer Joules out of administration, according to Drapers.

The outlet has revealed that the Brigadier Acquisition Company, which is owned by Menoshi Shina, is in talks with administrators Interpath Advisory about a potential rescue deal that could see a number of Joules stores rebranded as Crew Clothing Outlets.

However, the report suggests that no firm offer has been made and that Crew Clothing believes the Joules business would need to be 40% smaller in order for it to be viable.

Mike Ashley’s Frasers Group, Marks and Spencer, The Foschini Group (TFG) and Next are all said to be interested in considering a potential deal.

The news comes after Joules officially appointed administrators last week after talks with potential investors collapsed, with up to 1,600 jobs at risk.

Will Wright, Ryan Grant and Chris Pole from Interpath Advisory have been appointed joint administrators of Joules Group plc and Joules Limited. At the same time, Wright and Grant were appointed joint administrators of Joules Developments Limited and The Garden Trading Company Limited.

Earlier this month, the company announced it was in advanced discussions with a number of strategic investors regarding financing options for the group.

It spoke with a number of strategic investors, including Tom Joule, to provide a cornerstone investment in an equity raise, and said it would consult with key stakeholders, including suppliers, on its options.

However, its board confirmed the “discussions with various parties have not been successful and have now terminated”.

After confirming the appointment of administrators, the retailer said: “The company’s shares were suspended from trading on the AIM on 7 November 2022. The board currently expects that, in due course, the listing of the company’s ordinary shares will be cancelled, any residual value will be distributed to the company’s shareholders and the company will be wound up.”