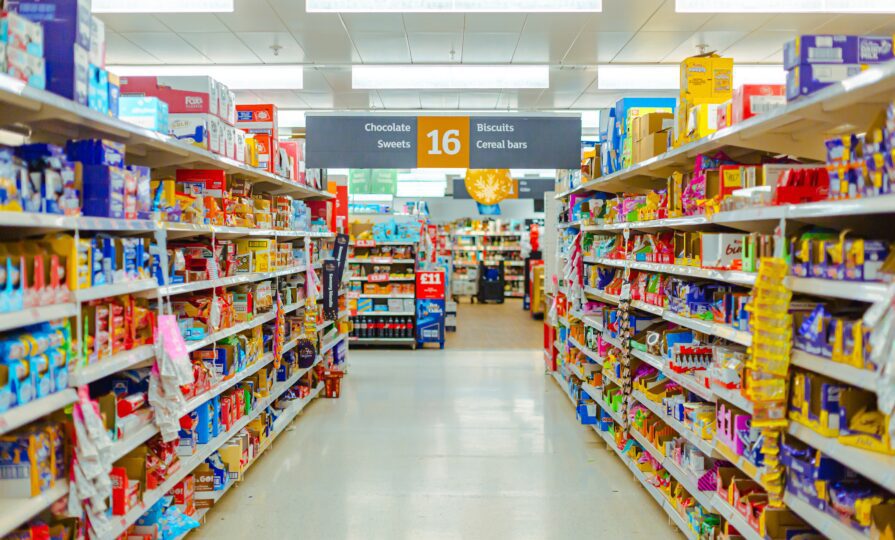

UK food inflation forecast to hit 5.1% this summer

Food price increases have overtaken energy bills as the top concern for consumers, the report also found

Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Food inflation in the UK is expected to peak at 5.1% in late summer 2025, outpacing general inflation, according to a report by grocery research group IGD.

In its latest Viewpoint report, IGD warned that rising food prices will put further strain on households and businesses as the UK economy continues to face slow growth and persistent cost pressures.

Food price increases have overtaken energy bills as the top concern for consumers, the report also found.

The forecast marks an upward revision from IGD’s previous estimate of 3.4% for 2025. It now expects food inflation to average 4% over the year, before easing to between 1.6% and 2.6% in 2026 and reaching about 1.8% in the first half of 2027.

According to IGD data, 83% of shoppers now expect retail food prices to continue rising, while 81% are concerned about costs of eating away from home. The IGD shopper confidence index fell to +1 in June, down from +3 in May, with three-quarters of consumers anticipating tax increases.

One in four shoppers expect their financial situation to worsen over the next year, the report said. That figure rises to 41% among lower-income households, up from 31% in May 2024, while just 11% of higher earners expect to be worse off – down five points.

While financially secure shoppers continue to spend on premium products and treats, IGD said younger consumers, particularly Gen Z, are driving demand for innovation, showing curiosity for new cuisines and formats.

IGD urged retailers, manufacturers and policymakers to stay attuned to changing consumer priorities around value, convenience and experience as they navigate the difficult outlook.

Michael Freedman, head of economic and consumer insight at IGD, said: “Amid economic uncertainty, shoppers are cautious with their finances, increasing private label purchases while reducing impulse and indulgence buys.

“We identified only 29% of consumers plan to cut back on grocery spending, suggesting many have already tightened their budgets and have little room to cut back further.”

He added: “Instead, shoppers are more likely to look for savings on discretionary purchases like clothing and eating out, underscoring a clear prioritisation of food shopping over other categories. Businesses should adapt to shifting customer behaviours by offering value, convenience, and memorable experiences to attract customers and drive growth.”