Natura and Co Q1 profits up 2.4% to BRL5.4bn

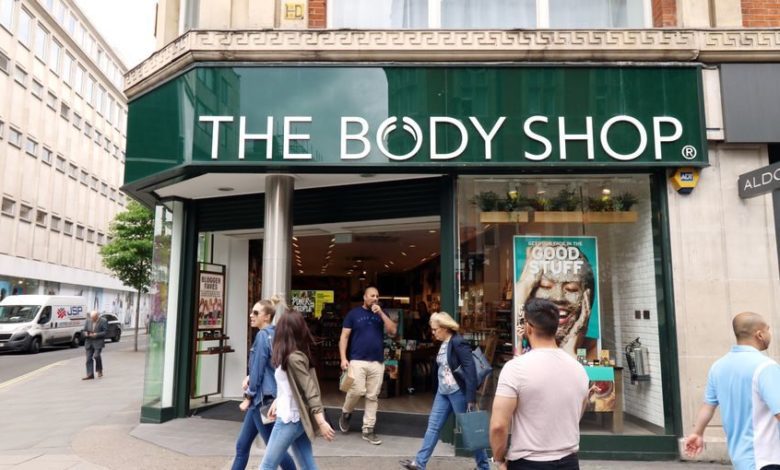

Body Shop, on the other hand, saw a decline in revenues of 16% in constant currency and was down 9.4% in BRL

Register to get 1 more free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Natura and Co has reported that its gross profits were up 2.8% to BRazilian Real (BRL) 5.4bn (£858m) in Q1 2023, compared with BRL5.2bn (£835m) it reported in the first quarter of 2022.

Its adjusted EBITDA was also increased 41.3% to BRL841m (£133m).

The brands Q1-23 consolidated net revenue was BRL 7.3bn (£1.16bn), up 2.2% YoY at constant currency and down 3.8% YoY in BRL

Body Shop, on the other hand, saw a decline in revenues of 16% in constant currency and was down 9.4% in BRL.

Natura and Co said that because the franchise sell-in was weak in the quarter, amid the rising inventory level that was highlighted last quarter, Body shop was still showing “top-line challenges”.

Its adjusted EBITDA also decreased by 6.1%, down 30 bps YoY.

Fábio Barbosa, Group CEO of Natura and Co, said: “Natura and Co’s performance in the first quarter is in line with our plan and with our previous communication, as Q1 numbers show a solid improvement both in gross and adjusted EBITDA margin, while the company continues to put in action important structural changes in its portfolio, focusing on simplifying its structure and improving its capital structure.

“Excluding Aesop, Q1-23 showed a strong profitability improvement, mainly driven by gross margin expansion across all business units and continuous cost control, that were partially offset by sales deleverage at The Body Shop, Avon Latam and, to a lesser extent, Avon International.”

He added: “This quarter’s gross margin expansion is driven by price increases carry-over and a more favourable mix, more than offsetting the inflationary environment we continue to experience. As per the normal seasonality of the business, cash consumption in Q1 was high, as planned, and working capital management was impacted by build-up of inventories for Q2 and changes related to the continued integration of Natura and Avon brands in Latam.

“From a revenue standpoint, the highlight remains the Natura brand, which continued its strong momentum from last year, with Natura Brazil sales growing 25%, led by volume and strong productivity growth.”

He concluded: “Shortly after the close of the quarter, Natura & Co announced important milestones, which are transformational for the future of the group. First, the group announced it has entered into a binding agreement to sell Aesop to L’Oréal for an enterprise