Government

Buy-now-pay-later to be regulated following FCA review

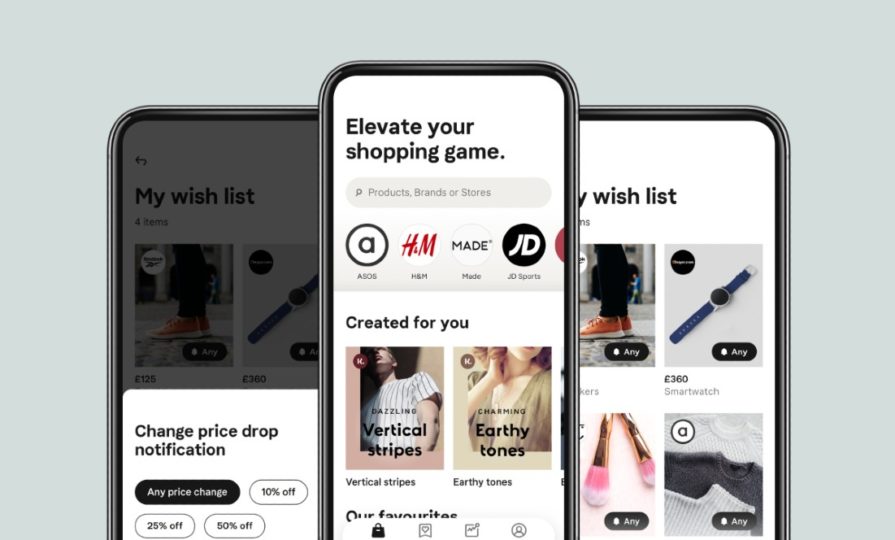

It comes as BNPL products have seen a ‘rapid’ increase in popularity as the pandemic has continued to drive online shopping

Buy-now-pay-later schemes are set to face stricter regulations and controls after the Financial Conduct Authority (FCA) published a review into the unsecured credit market.

You'll need to

subscribe to unlock this content. Already subscribed? Login?