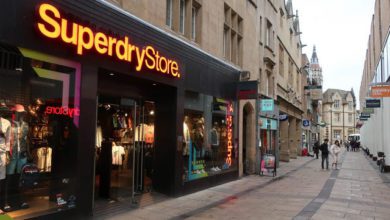

Superdry secures funding as sales fall

Superdry has secured a new £70m lending facility in a bid to equip it with “flexibility and liquidity” following the coronavirus crisis.

It comes as the disruption from the pandemic has continued to “materially impact” its year-on-year performance, despite the fact that trading was ahead of initial expectations in its first quarter.

During the three month period ended 25 July, total group revenue fell by 24.1% largely due to the impact of store closures as a result of Covid-19.

Around 95% of its stores have now reopened, with store revenue down 58.1% against the year prior, equivalent to a like-for-like decline of 32.3%.

In addition, the group noted that its wholesale partners and franchisees have “suffered the same headwinds and challenges” as its owned stores, with year-on-year revenue down by 31%.

Despite this, online business has “continued to perform well”, with sales up by 93.2% in the first quarter, though this has normalised in recent weeks as stores continued to reopen.

As of 6 August, the retailer has net cash of £57.8m, against the £39.8m reported on 7 May and the £2.1m reported on 6 August 2019.

According to the group, this “strong position” is largely due to the “significant and decisive management actions taken to preserve cash” amid the crisis.

Its latest £70m loan has been agreed through its existing lenders, HSBC and BNPP, and replaces the existing facility that the company had in place, which was due to expire in January 2022.

Julian Dunkerton, CEO, said: “The actions we have taken to date have greatly strengthened our cash position, which together with our new ABL Facility, give us the flexibility to execute our current plans and to secure our recovery.

“Together, we are making our way through this unprecedented period, and I’m confident we can reset the brand and deliver on our transformation plans.”