Clothing & Shoes

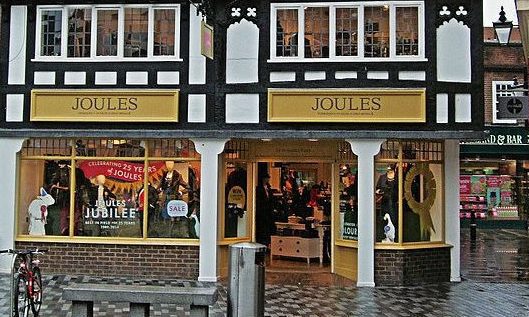

Joules lowers H1 profit guidance amid global supply issues

The lower profit expectation was attributed to the ‘well-documented’ global supply chain issues which have resulted in some higher costs and stock delays during the period

Retailer Joules expects to report lower pre-tax profits for the 26-week period ending 28 November ranging from £2m to £2.5m, compared with last year’s result of £3.7m.

You'll need to

subscribe to unlock this content. Already subscribed? Login?