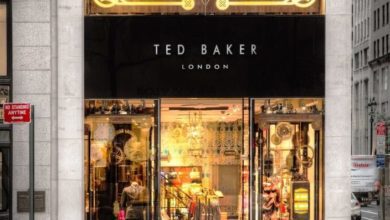

High Street

Ted Baker completes bank refinancing after Covid halts results

It follows an announcement made by the group that it would delay the publishing of its preliminary results for the 53 weeks ended 30 January

Ted Baker said it has signed an extension to its revolving credit facility (RCF) with its existing lending syndicate.

You'll need to

subscribe to unlock this content. Already subscribed? Login?