High Street

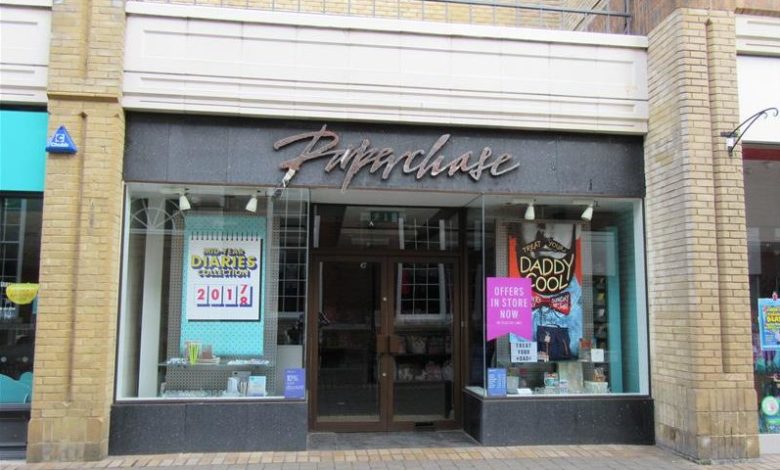

Paperchase sees key credit insurer reduce cover

Paperchase is facing increasing pressure as one of its main credit insurers has reduced its cover after the company posted a slump in profits.

You'll need to

subscribe to unlock this content. Already subscribed? Login?