Register to get 2 free articles

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Shopping centre and retail park giant, Hammerson, has announced plans to reduce the size of its board and sell off £1.1bn in retail parks.

The announcement, which comes just after the company sold parks in Bristol and Kirkaldy for £164m, said the company was planning to focus on “flagship retail destinations” and “premium outlets” as it looks to leave the retail park sector over the medium term, and also plans to “lower corporate costs” related to the board and management.

As a result, CEO Peter Cole is set to step down from the board alongside Jean-Philippe Mouton who will remain managing director of the company’s French operation.

Hammerson, which is behind London’s Brent Cross and Birmingham’s Bullring, said it expects to save £7m from board cuts, and aims to hit its £1.1bn target by the end 2019. So far the company has raised £300m.

Along with retail park sales and board cuts the company is postponing development work at Brent Cross and has commenced a share buyback of up to £300 million. Shares in Hammerson rose by 1.2% this morning as a result of the news.

Hammerson CEO David Atkins, said: “Our reshaped strategy sees us taking decisive action to further reposition our portfolio. Through increasing the level of disposals, including exiting the retail parks sector, we will now focus solely on winning destinations of the highest quality: flagship retail destinations and premium outlets. These are the venues we believe will maintain relevance and outperform against the shifting retail backdrop.

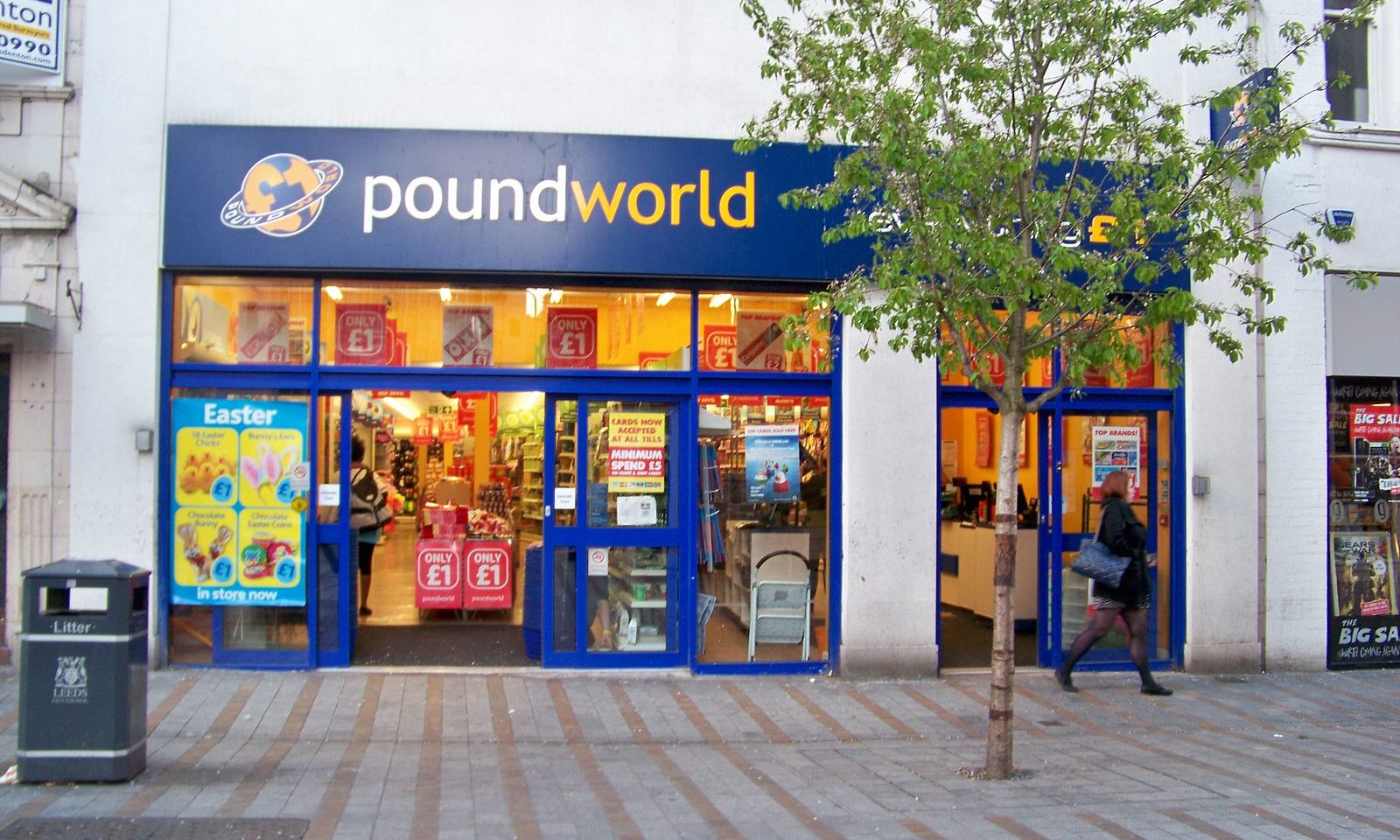

“Our customer and retailer offer will be amplified, and this includes a step change in our retailer line up. We will reduce the amount of floor space let to department stores and high street fashion as we actively focus on the latest consumer trends and take bolder steps to provide the best retail mix.

“Our results today demonstrate the resilience of our business. We are taking tough decisions and have absolute conviction in our ability to deliver. By reprioritising our capital deployment and repositioning our portfolio, we will accelerate future shareholder value and returns.”