Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

The value of UK retail properties fell by 0.8% in June, the biggest monthly fall since May 2012.

According to figures released by real estate company CBRE, in June UK high street shops’ capital values dropped by 1.3% while shopping centres saw a decrease of 1.1%.

CBRE’s Monthly UK Index showed that in Q2, the capital values of the retail properties dropped by 1.3%, pulled down by shopping centres which decreased by 2.3%. Other retail properties saw a 1.9% fall in Q2. Retail rental values also fell by 0.5% in Q2.

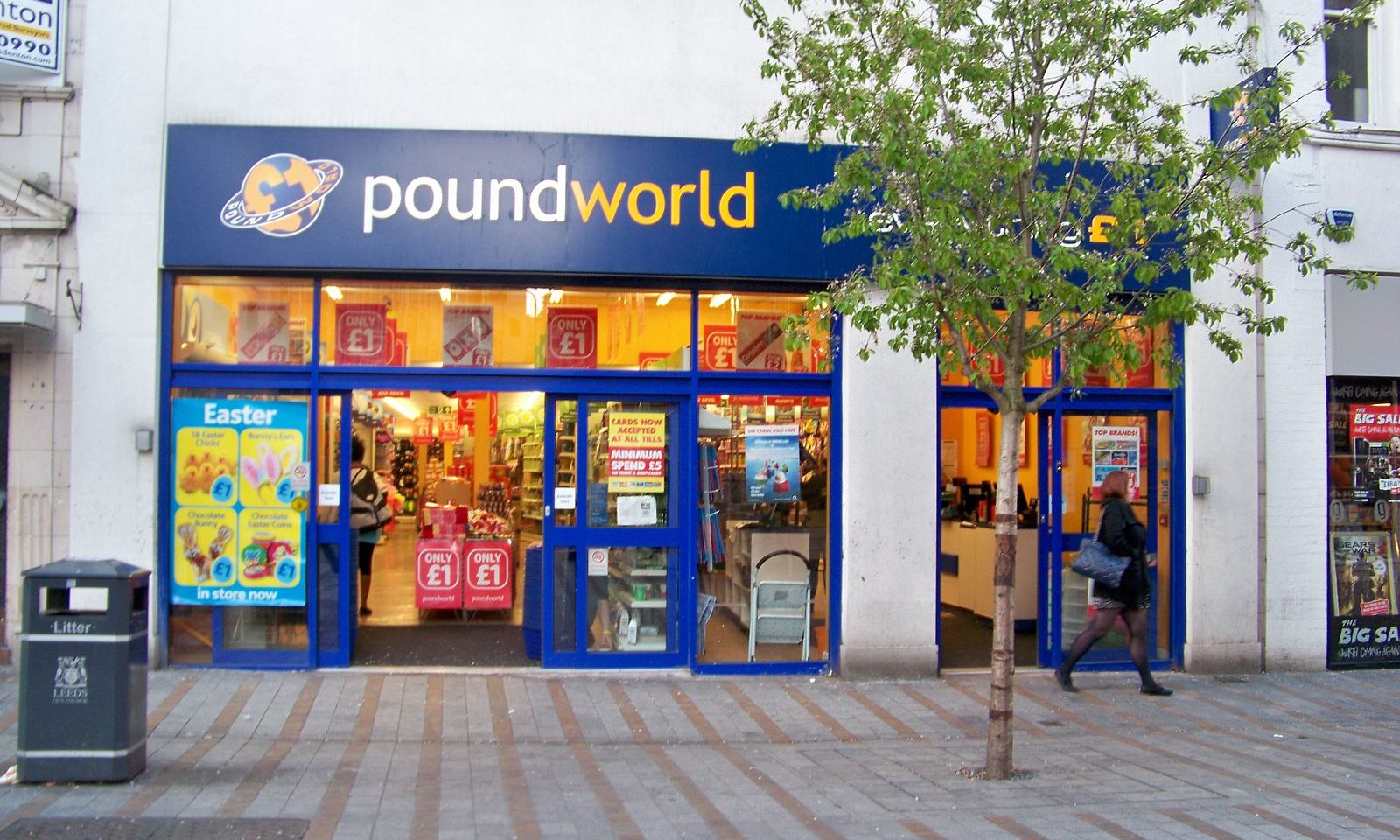

The researchers attributed the retail sector’s performance to the number of recent company voluntary agreements (CVAs) that it has seen. Since the beginning of the year, House of Fraser, Calvetron Brands, New Look, Mothercare and Maplin have been among some of the major retailers which have gone into administration or entered a CVA.

UK commercial properties saw an overall capital increase of 0.2% for the month, with the industrial sector and office capital values both rising by 1.7% and 0.3% respectively.

Miles Gibson, head of UK research at CBRE, said: “June’s results throw a spotlight on the contrasting fortunes of two market sectors. The industrial sector continues to enjoy strong occupier and investor demand. The recent run of CVAs is having a noticeable, but perhaps not surprising, impact on half-year retail valuations.”