Register to get 2 free articles

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

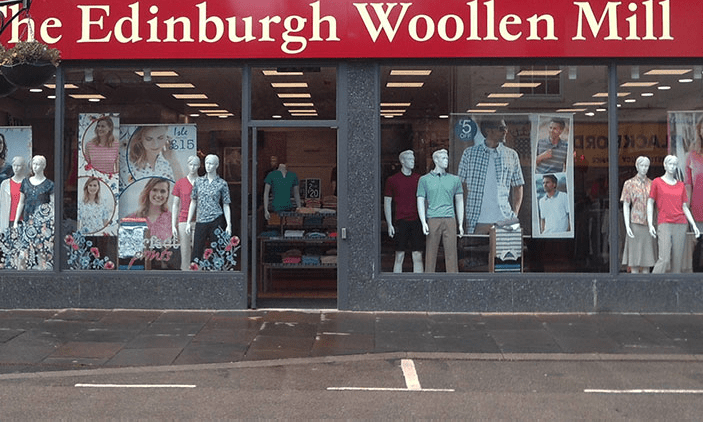

Retail tycoon Philip Day is reportedly considering the sale of his retail chains Peacocks and Edinburgh Woollen Mill (EWM) and has appointed FRP to seek out interest in the businesses.

According to the Sunday Times, Day appointed FRP after receiving an unsolicited enquiry for Peacocks last month.

The two chains employ over 7,000 people and operate over 900 stores, however it is thought that Peacocks has so far reopened less than half of its 550 stores.

The paper also claims that FRP was asking for offers to be submitted by the end of last week (18 September).

It is also reported that any potential sale would be on a solvent basis.

Earlier this year Peacocks, which recorded half-year pre-tax profits of £21.2m back in March, acquired Embattled high street retailer Bonmarché out of administration.

Peacocks acquired around 200 stores in the deal after administrators felt it was “the best opportunity to maximise returns for creditors and sell the business on a going concern basis”.